The Most Contentious Bills in the Budget

Last week, the House and Senate were in adjournment so that members could work on the state budget. All scheduled committee meetings that were related to the budget were suspended.

This week, the House voted on a few measures: HB 195, HB 292, HB 487, HB 538, HB 716, HB 758, HB 759, HB 765, HB 777, HB 780, HB 781, HB 786, HB 792, and HR 1023.

The two most contentious bills that were voted on was HB 758 and HB 792 (Supplemental budget).

HB 758 would prohibit the usage of a “motor carrier safety improvement” by or as required by a motor carrier or its related entity as factor when evaluating whether an individual is an employee, independent contractor, or jointly employed employee under any state law. Teamster Union Local #758 opposed this bill. This bill will negatively affect truck drivers who believe they should be classified as employees and not classified as independent contractors. this bill prevents evidence that a trucking company required a trucker to use specific safety equipment from ever being presented in a state court legal action challenging a driver’s misclassification. This prohibition would limit the truck driver’s right to an unemployment or workers compensation claim. The bill passed the Chamber along party lines.

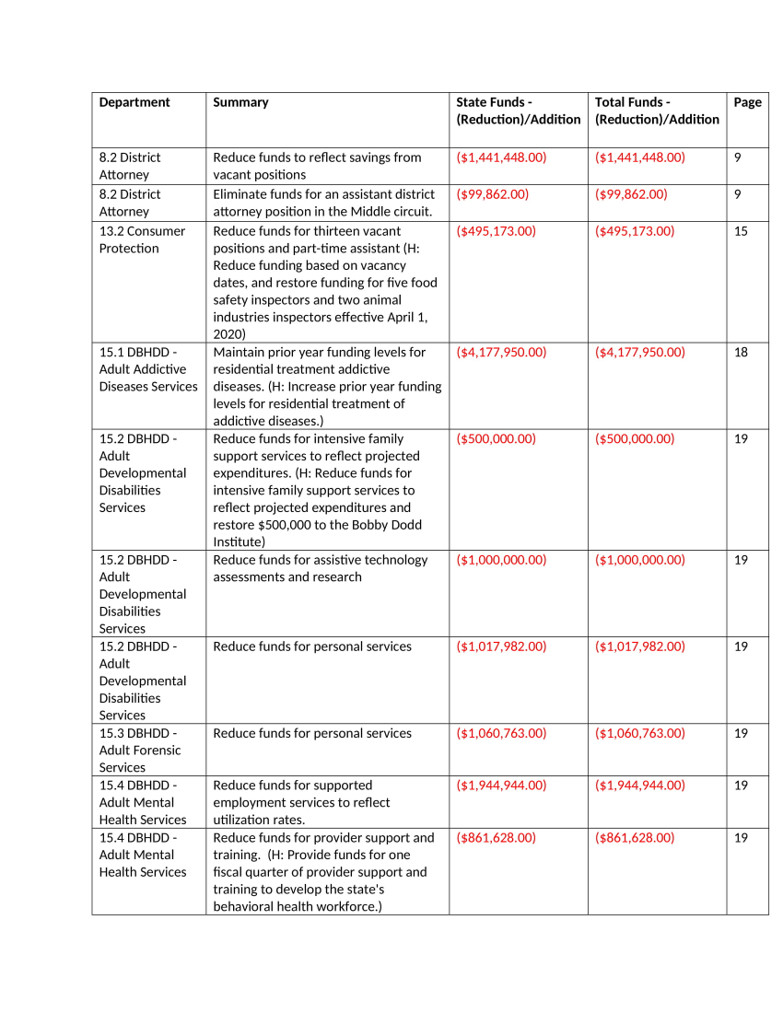

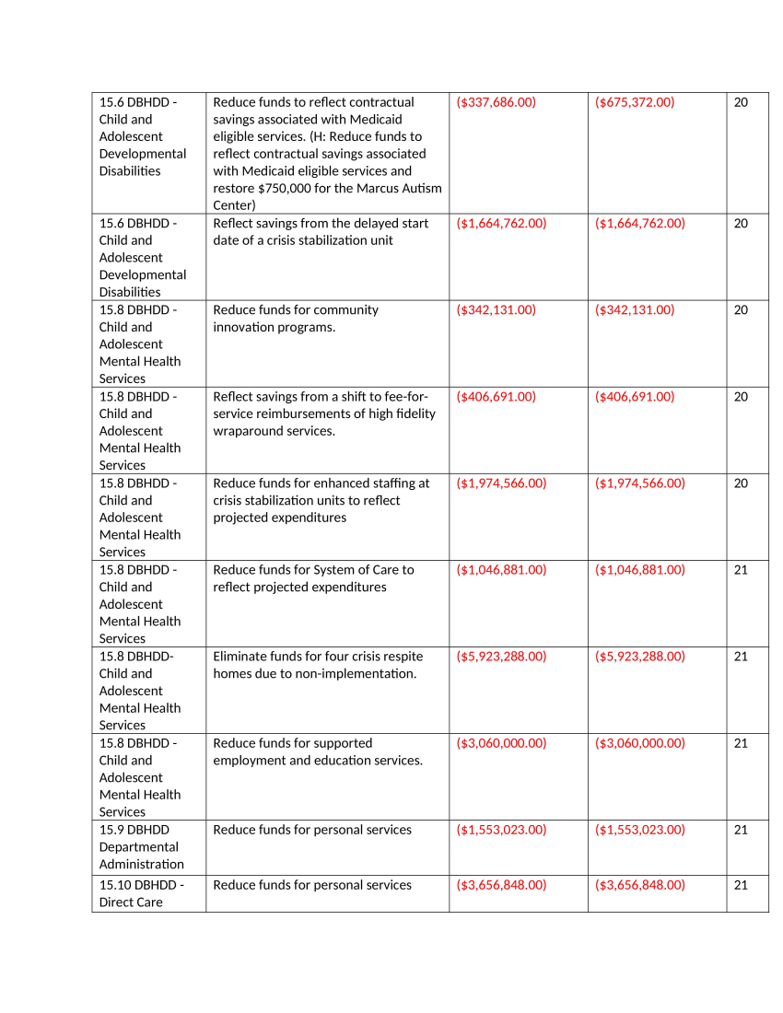

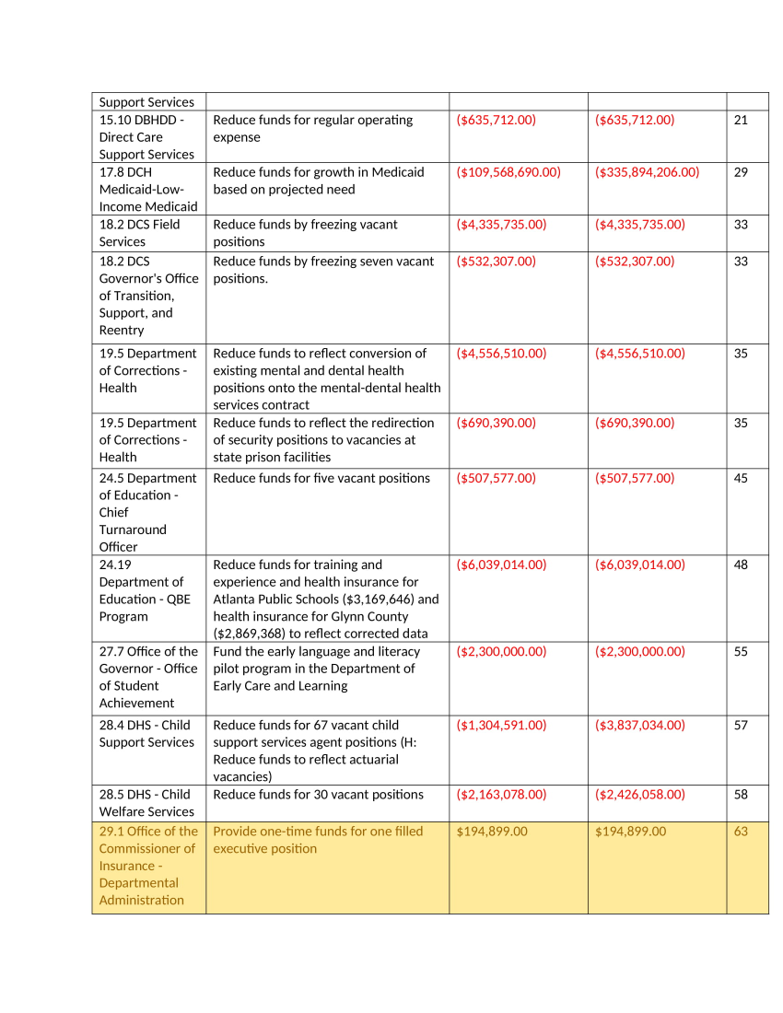

HB 792 is the Supplemental budget for FY 2020. This bill contained concerning cuts to essential services that Georgians all across our state depend on. A summary of the cuts are below:

The bill passed with 46 “no” votes. These bills now go to the Senate.

The bill passed with 46 “no” votes. These bills now go to the Senate.

What we are watching

- The Budget

- HB 432 – would abolish the state’s current system of tax rates that increase from 1 to 5.75 percent as incomes rise – known as a graduated tax system – in favor of a 5.5 percent flat tax structure.

- HB 444 – The Dual Enrollment Act would maximize the number of dual enrollment credits to 30. A student may use their HOPE scholarships and grants towards their dual credit classes, but the dual credit classes will be deduced from the maximums allowed under HOPE. This bill can come up as an Agree/Disagree at any time. Senate Democrats voted against the measure earlier this year and a majority of House Democrats voted against the measure last year.

- HB 593 – seeks to establish a retirement fund for county tax commissioners. A significant source of funding for this new retirement funding will come from an additional $3 fee applied to delinquent tax bills. This fee is only applied to those who are already paying additional late fees and interest on their tax bills. It is unnecessarily punitive for this retirement fund to be built from additional fees applied only to those already struggling with their tax payments.

- HB 751 – The Anti – Red Flag – Second Amendment Conservation Act would allow preemption of local regulation and lawsuits, and exceptions, so as to occupy and preempt the entire field of legislation in this state involving extreme risk protection orders

- HB 757 – relating to primaries and elections generally, so as to provide for the determination of qualifying periods for special elections; to provide for voter registration deadlines for special primary runoffs and any other election or runoff held in conjunction with a special primary runoff. This bill passed out of the Governmental Affairs committee this week. The change in the bill gets rid of jungle primaries in special elections for State House and State Senate races starting in 2021.

- HB 784 – relating to exceptions of open meeting rules, this bill would allow local school board members to discuss and vote on school safety plans in sessions closed to the public.

- HB 915 – the Georgia Anti-Sanctuary Act would require the state to adhere to federal immigration laws in Georgia with respect to criminal “illegal aliens.”

- HB 918 – was enacted in 2018 – 2019 to restructure the state’s personal and corporate income tax provisions, could still serve as the basis for a vote on an additional reduction to lower the state’s top income tax rate from 5.75 to 5.5 percent. This change (combined) would cost the state approximately $615 million per year.

- SB 368 – relating to children and youth services, this bill would prohibit child-placing agencies from being required to perform, assist, counsel, recommend, consent to, refer, or participate in any placement of a child for foster care or adoption when the placement violates certain religious or moral convictions of the child-placing agency.